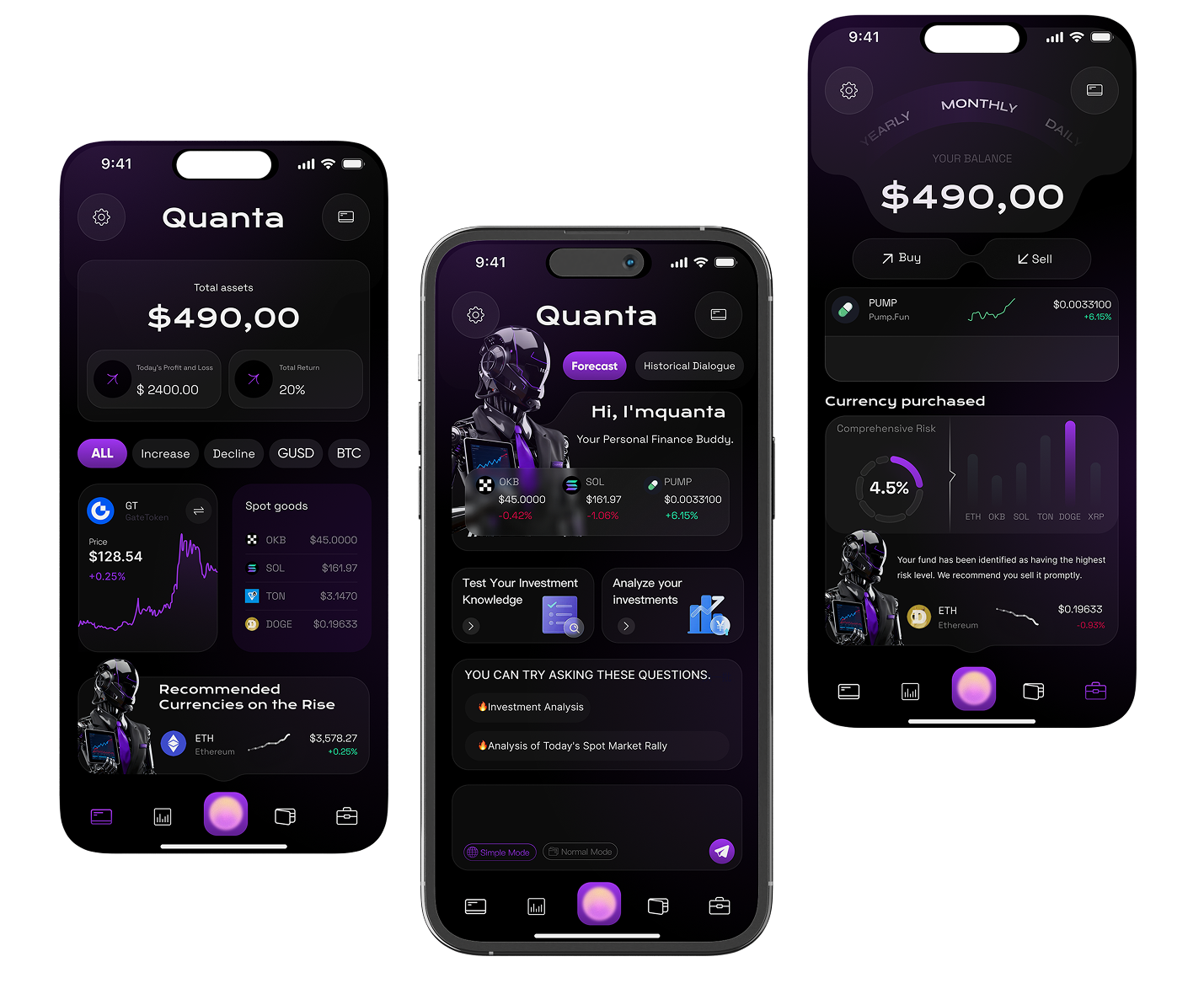

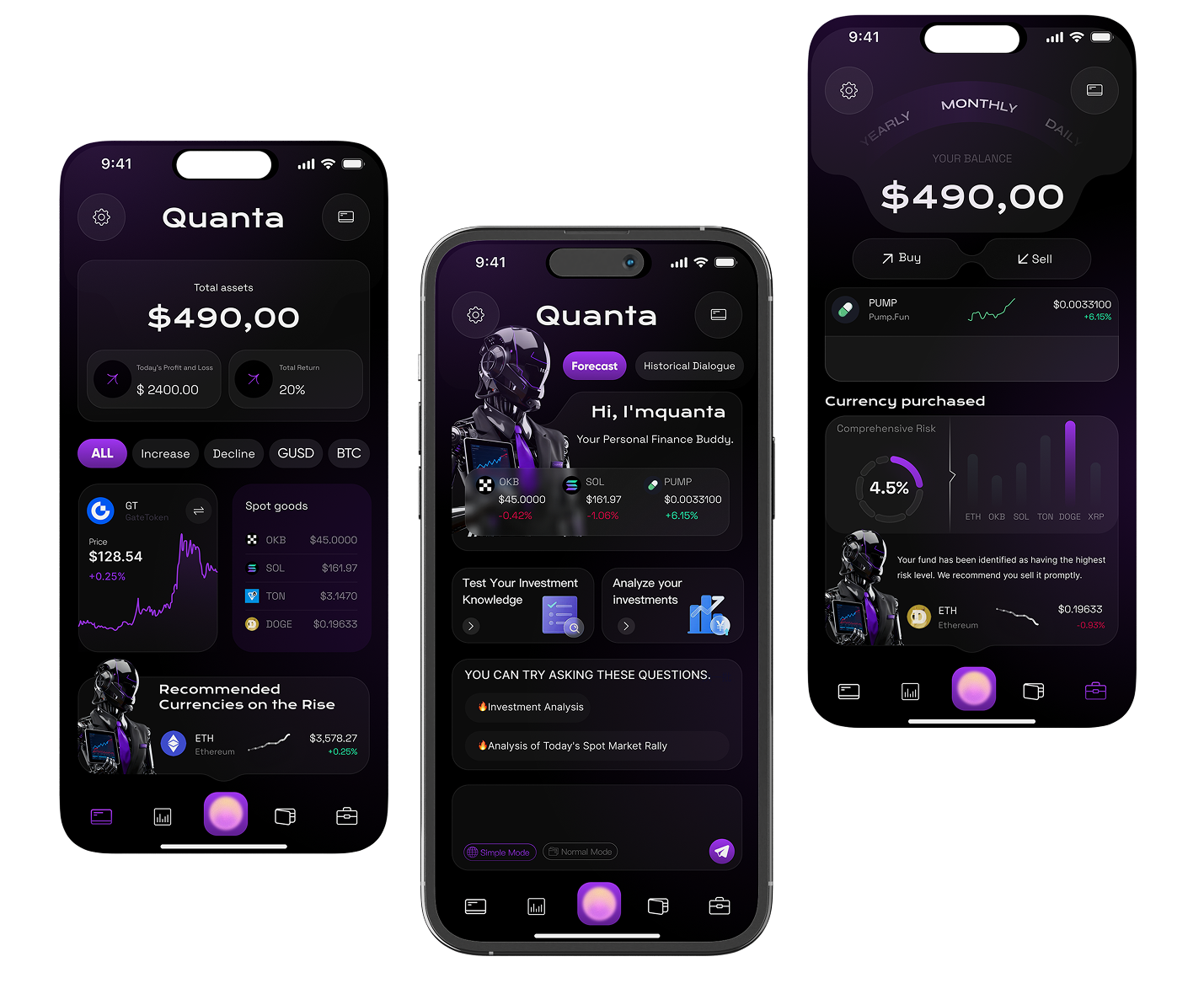

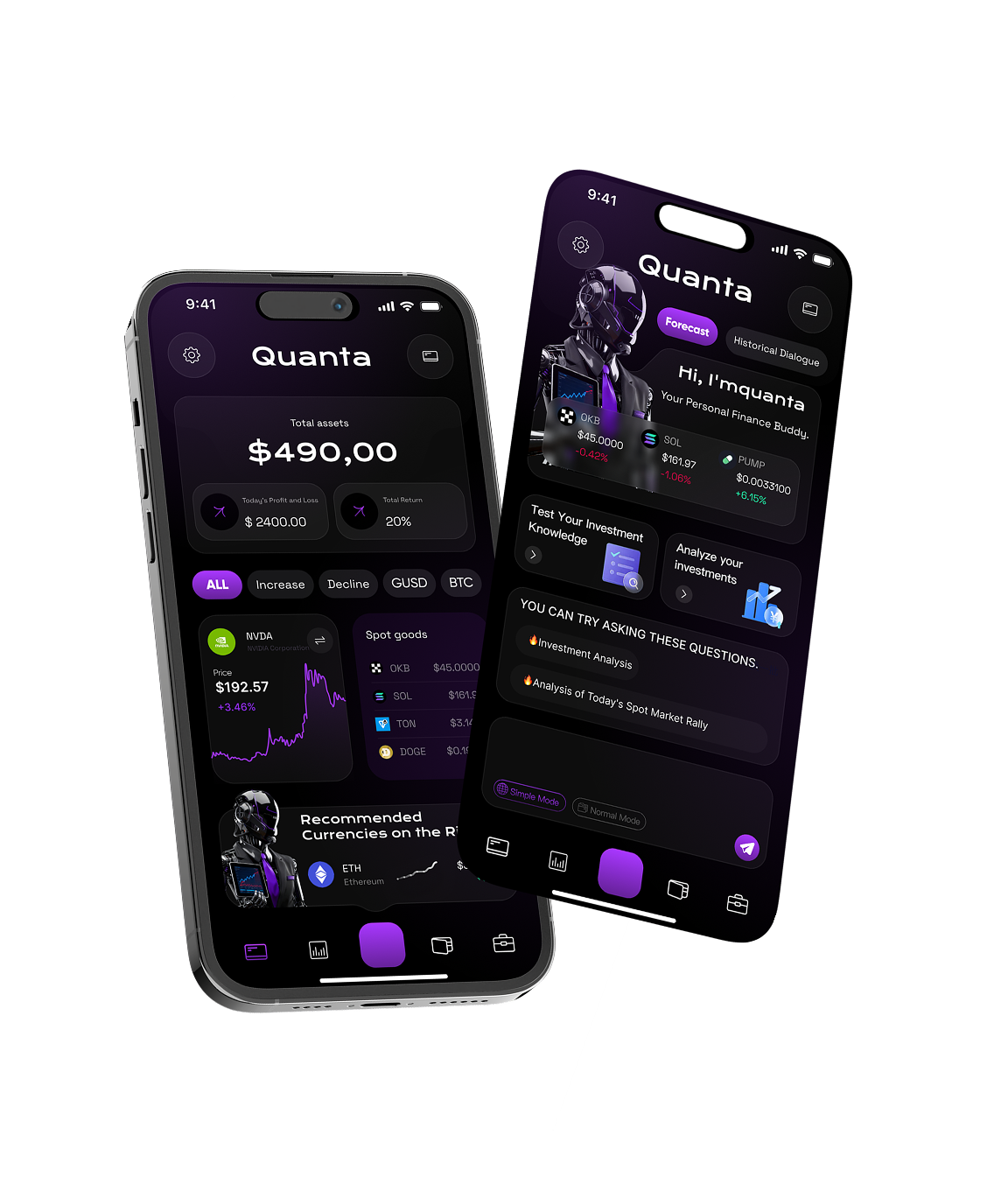

Your Smart Investment Expert

Tired of complex data and market noise? It's time to have a 24/7 online smart investment expert.

Tired of complex data and market noise? It's time to have a 24/7 online smart investment expert.

Set your investment strategy, and let our intelligent system automatically monitor and execute trades, overcoming human weaknesses.

Monitor global markets 24/7, intelligently interpret financial news, and never miss a crucial opportunity.

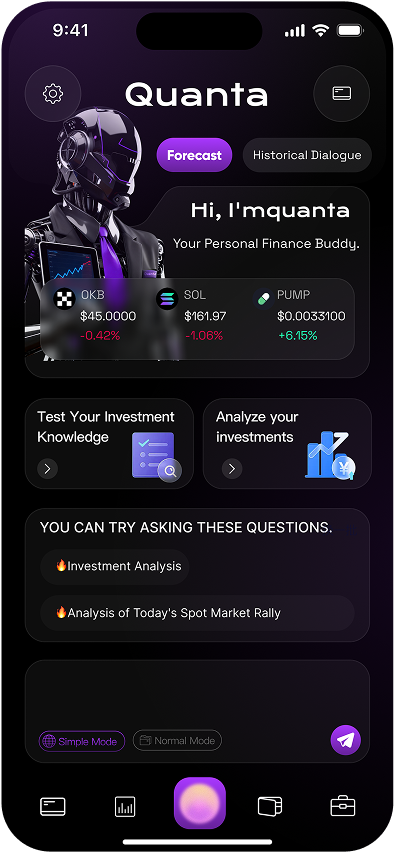

Quanta learns from your habits, adapts to your workflow, and fits seamlessly into your routine. It's not just smart — it's personal, intuitive, and built to enhance.

Based on big data and machine learning, AI intelligently simulates future product trajectories and assigns scores, maximizing factors such as market trends and industry cycles.

At any time, for any question about any product—whether it's "Is this fund suitable for long-term holding?" or "What exactly are the risks of this wealth management product?"—AI is always ready to answer, like an investment advisor who never takes a break.

Struggling to choose between two options? Let AI analyze multiple products simultaneously and compare them side-by-side across dimensions like returns, risks, and cost-effectiveness to help you make the optimal decision.

Simply enter the product name or code, and the AI will instantly analyze its historical performance, risk level, holding structure, manager background, and more, generating an easy-to-understand in-depth report.

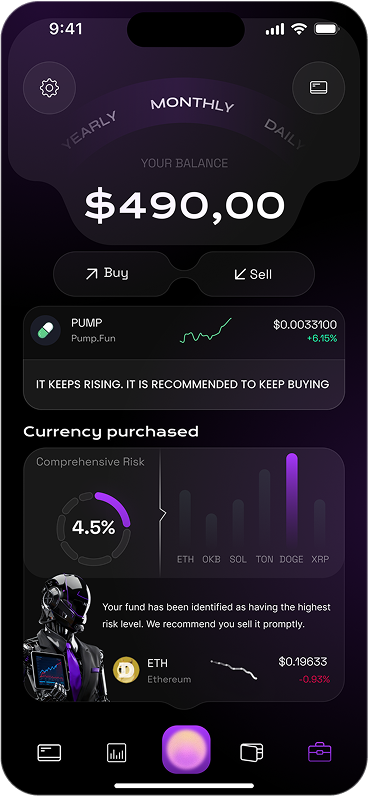

One-click portfolio synchronization instantly triggers an AI-powered "risk checkup" for your entire asset portfolio—including stocks, mutual funds, and cryptocurrencies—generating an easy-to-understand risk score and health report.

Based on your risk tolerance, AI will filter through a vast array of products to identify "conservative" or "balanced" assets that align with your profile, helping you optimize your portfolio and diversify risk.

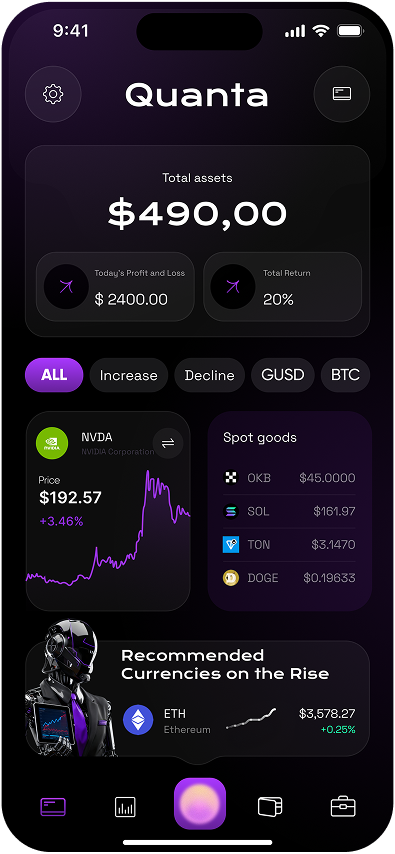

I've always wanted to add to my position in a certain tech fund, but I kept feeling the price was too high. Last month, when the market took a sharp dive, the AI's "buy signal" suddenly lit up, indicating "market panic has shifted this fund's risk-reward ratio to favorable territory." I decisively added to my position, and now the returns are already quite impressive. This made me realize that buying opportunities are hidden within risk data.

I've been holding mainstream cryptocurrencies long, but the daily price swings always make me anxious. AI's 'Risk Quantifier' feature tells me my Bitcoin holdings fall within the 'Moderate Risk' range and provides historical volatility comparisons. Seeing this data actually gives me peace of mind—I no longer feel compelled to make impulsive trades based on short-term fluctuations.

Earlier, I heavily invested in a small cryptocurrency, convinced it was about to skyrocket. But when I scanned it with AI, its 'liquidity risk' shot straight to red alert! The AI warned this coin could crash dramatically. Skeptical but cautious, I reduced my position—and sure enough, a week later it plummeted 30%... This risk prediction truly saved me.

Once the platform is launched, users will be able to access our services through the Apple App Store and Google Play Store.